- India’s EV* sales* nearly doubled in 2023, driven by rising consumer interest, government initiatives, infrastructure development, and concerns over climate change.

- Projections for 2024 show EV sales rising 66% to constitute 4% of total passenger vehicle (PV) sales, driven by new entrants and government subsidies.

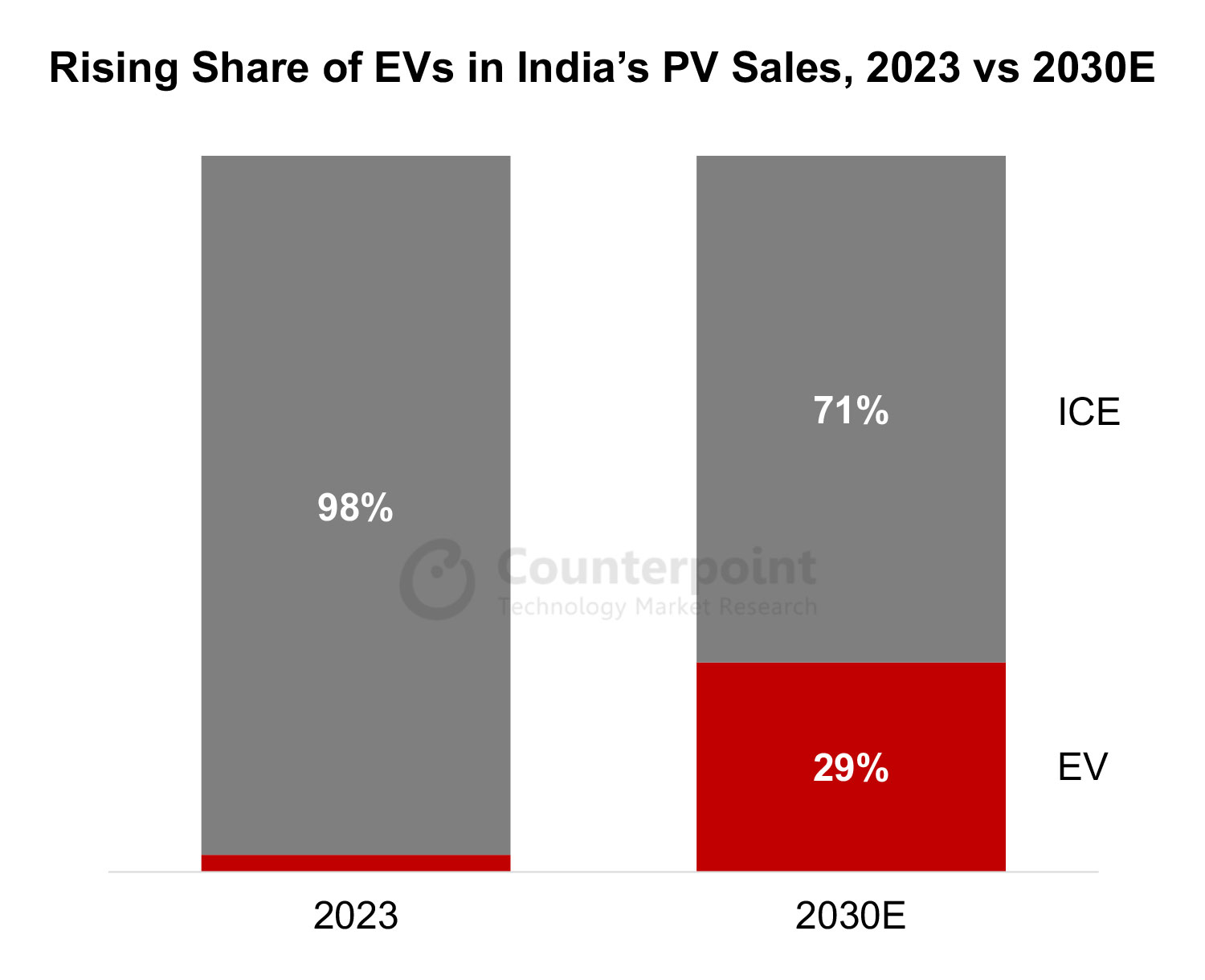

- By 2030, EVs are expected to represent nearly one-third of India’s PV market, signaling a robust long-term growth trajectory in the country’s automotive sector.

New Delhi, Beijing, Boston, Buenos Aires, Fort Collins, Hong Kong, London, San Diego, Seoul, Taipei – April 5, 2024

In 2023, even as India’s passenger vehicle (PV) sales* grew 10% YoY, its electric vehicle (EV*) sales nearly doubled to account for 2% of the overall PV sales. This EV surge can be attributed to multiple factors, including increasing urban consumer interest, government initiatives, infrastructure development, and concerns over climate change.

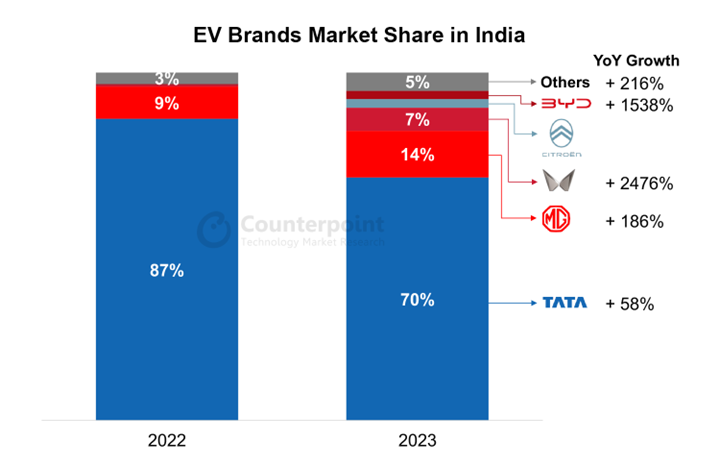

With a strong portfolio and strategic tie-up with Uber, Tata Motors held more than two-thirds of the country’s EV market in 2023 but lost some share to Mahindra & Mahindra and BYD. Recording a 2476% increase with just one model in its portfolio, Mahindra & Mahindra was the fastest-growing brand in 2023, followed by BYD and MG Motor.

Mahindra’s growth can be attributed to its aggressive marketing efforts around the all-electric SUV XUV400 launched in 2023.

BYD, with just two models in its India line-up – e6 MPV and Atto 3 SUV, grew over 1500% in 2023. Despite belonging to the premium category, BYD secured a position among the top five EV brands in India, showcasing remarkable success in the growing EV market.

BYD’s recent launch of the Seal model is expected to further enhance the brand’s market presence and competitiveness, adding to the dynamic shifts occurring in India’s EV market.

Note: Citroën entered the market in 2023

Outlook

According to Counterpoint Research’s India Passenger Vehicle Model Sales Tracker, EV sales in India are expected to increase by 66% in 2024 to constitute 4% of total PV sales. Looking at 2030, EVs are expected to constitute nearly one third of the India’s PV sales.

Maruti Suzuki’s entry into the EV market is expected to shake up Tata’s dominance. Moreover, VinFast’s move to build a factory in India’s Tamil Nadu state highlights the growing interest and investment in EV manufacturing in the country. All this not only signifies increased competition but also reflects the evolving landscape of the automotive industry toward sustainable and eco-friendly technologies.

Commenting on the supply chain development, Associate Director Liz Lee added, “India’s EV landscape is on the cusp of significant growth. The rise in EV battery manufacturing, supported by key players like Ola, Reliance New Energy and ACC Energy Storage, alongside the Make in India initiative, will lower manufacturing costs and boost EV sales. Government initiatives such as the PLI scheme for Advanced Chemistry Cells (ACC) and the recent reduction in import duties on EVs over $35,000 to 15% are game changers. All this not only opens doors for Tesla but also signals India’s readiness to welcome significant investments and foster a new ecosystem for EVs and their component suppliers. It is a clear sign that India’s journey to become a major player in the global EV market is accelerating.”

Commenting on the market outlook, Research Vice President Neil Shah said, “The EV ecosystem is in a fairly nascent stage. As the infrastructure and consumer traction develops, we will see the entry of newer players such as Tesla and fast-growing Chinese brands like Xiaomi, which will catalyze innovation and competition in the world’s fourth-largest PV market. Besides, while the conventional automobile manufacturing ecosystem is mature, the building blocks for a robust smart car manufacturing ecosystem, from the battery to infotainment to sensors to full ADAS/ADS, beckon. We will see players in the broader value chain prioritizing India’s market not only to target domestic consumption but also for technology R&D and export opportunities. This would span from the likes of Qualcomm and MediaTek designing and offering advanced auto components to BlackBerry providing safety and security software, to Foxconn reducing barriers for new entrants to India with its innovative MIH consortium-based ‘localized’ design and manufacturing model.”

*Notes:

EVs here include battery EVs (BEVs) but not plug-in hybrid EVs (PHEVs).

Sales here refer to wholesale figures, i.e. deliveries out of factories by respective brands.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Related Posts

The post India EV Sales Nearly Double in 2023, to Rise 66% in 2024 appeared first on Counterpoint.